Free trade zone

Introduction

The Free Zones are included in a special, comprehensive and simplified regime to encourage the establishment and operation of companies that contribute to the development of the country through the generation of jobs and the contribution of foreign currency, and are incorporated into the global economy of goods and services. thereby seeking to promote investment and boost the economic, scientific, technological, cultural, educational and social development of the country. Currently, there are 11 active free zones, while another 9 are under development, located mainly in the cities of Panama and Colón.

The Free Zones in Panama are protected under Law 32 of April 5, 2011 and regulated under Executive Decree No. 62 of April 11, 2017, legal regulations in which the tax, immigration and labor benefits that make them attractive its development within the national territory.

- Location

Legal frame

Regulating Law 32 of April 5, 2011 that establishes a special, comprehensive and simplified regime for the establishment and operation of free zones and dictates other provisions

Executive Decree number 62 of April 11, 2017 that regulates Law 32 of April 5, 2011 that establishes a special, comprehensive and simplified regime for the establishment and operation of free zones and dictates other provisions

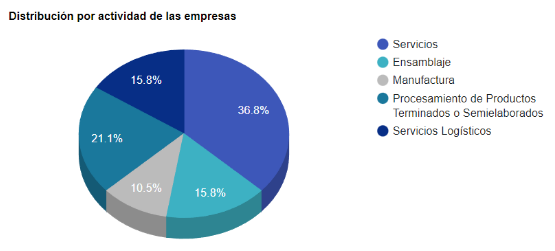

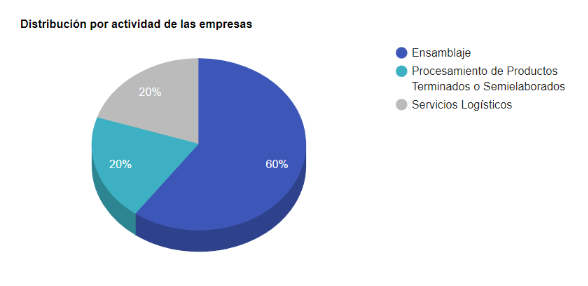

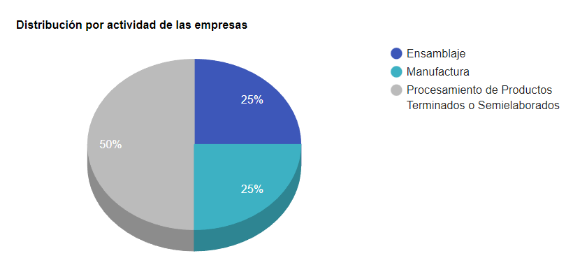

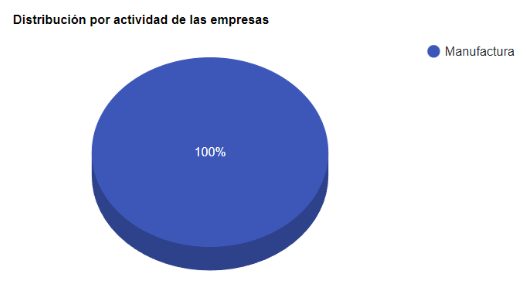

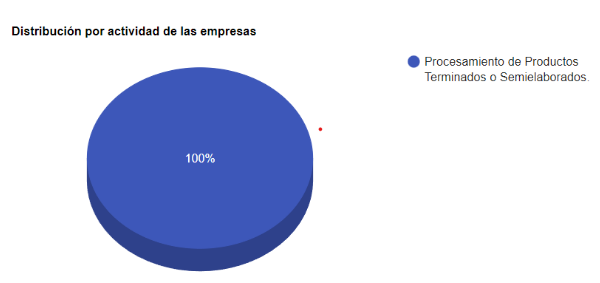

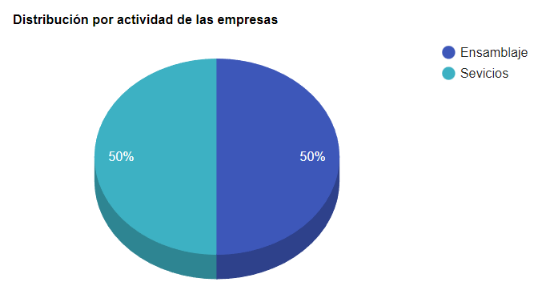

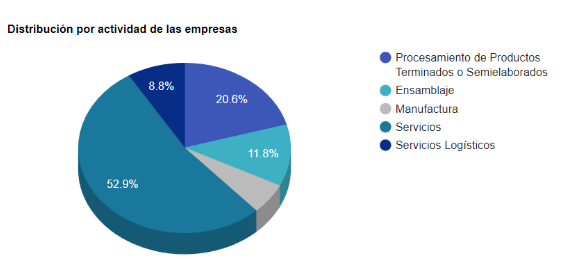

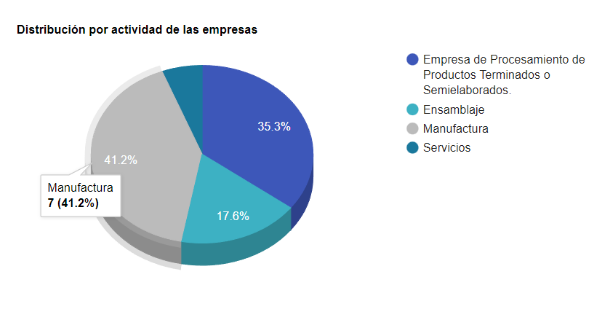

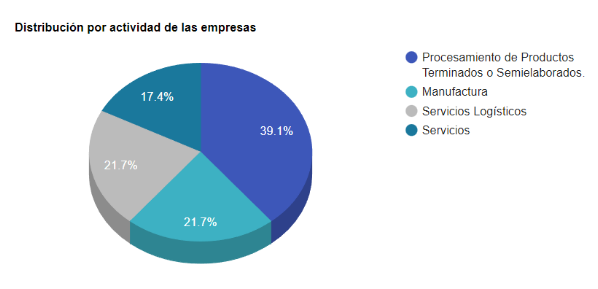

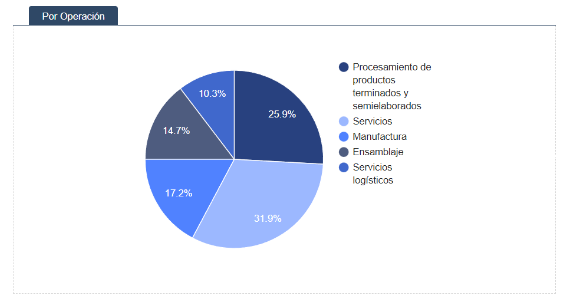

Types of companies

In the Free Zones they will have the power to establish natural or legal persons, national or foreign, which are destined to the following activities:

- Manufacturing company

- Assembly company

- Processing company for finished or semi-finished products high tech company

- Logistics service company

- Environmental services company

- Specialized center for the provision of health services

- Higher education center

- Scientific research center

- Service company

- General service company

Las licencias que otorga el Ministerio de Comercio e Industrias (MICI) con referencia a las Zonas Francas son:

1. Licencia como Promotor y / o Operador de Zona Franca

2. Licencia de Operación como empresa establecida en Zona Franca

Benefits

According to legal regulations, there is a wide range of tax benefits in direct and indirect taxes, rates, rights and levies. These benefits can be summarized in:

Exemption from taxes and other import duties on raw materials and/or semi-finished products, in addition to the purchase and import of construction equipment and materials, machinery, spare parts, tools, accessories, inputs, packaging materials and all goods and/or service required for business operations.

Exemption from income tax on the leasing and subleasing of premises or land for free zone developers.

The exemption from income tax for Service Companies, Logistics Service Companies, High Technology Companies, Scientific Research Centers, Higher Education Centers, General Service Companies, Specialized Centers for the Provision of Health Services and Healthcare Companies. Environmental Services, for its operations, both external and mutual (according to Chapter V, Articles 31 – 37 of Law 32)

In turn, a special immigration regime is established, whose benefits consist of:

- Permanent Resident Permit as an investor.

- Temporary Resident Permit as trusted personal, executives, experts and/or technicians, valid for the term of the contract.

- Short-stay Visa as a Merchant and Investor, by special laws, valid for nine months, to carry out transactions or businesses in export processing zones.

- Temporary permits due to special policies: teacher, student or researcher of a Higher Education Center in a Free Zone; researcher at a Scientific Research Center.

- The permits would be extensive, under equal conditions, to the spouse and minor and older dependent children of the main applicant (Chapter VII, Articles 43 - 53)

Igualmente, se establecieron disposiciones laborales especiales, que ofrecen ciertas flexibilidades a las empresas establecidas en estas áreas económicas que son distintas a las vigentes en el resto del territorio nacional:

- Worker rotation is allowed

- The vacation period may be agreed between the parties

- The extraordinary day will be remunerated with a single surcharge of 25% on the salary

- Work on a national holiday or mourning day will be paid with a surcharge of 50% on the salary of the ordinary day. (Chapter VIII, Articles 54 - 64)

Zonas Francas Activas

Albrook Free Zone (Albrook Export Processing Zone, S.A.)

Last updated: January 2022

- Albrook Export Services, Inc.

- Anticorrosivos Y Acabados Aya, S.A.

- Cargas Veloces, S.A.

- Centralam Panamá, S.A.

- Cgl Storage, S.A.

- Drv Logisctic Pty, S.A.

- Eco Industries 507, Inc.

- Furnitech, S.A.

- Himoinsa Pty, S.A.

- Inspectorate Panamá, S.A.

- International Paint Panamá, S.A.

- Intertek Calet Brett Panamá, Inc.

- Marinsa Panamá, S.A.

- Maritime Security Services, S.A.

- Operadora De Servicios Alternos, S.A.

- Optima Ballistic Glass Corporation, S.A.

- Overseas United, Inc.

- Technoelectromecánica Y Telecomunicaciones, S.A.

- Transporte Rodaro, S.A.

- Ceferina Girón (Administrator)

- Phone: +560-0686

- E-mail: [email protected]

- Location: Albrook, Ancon, Panama

Zona Franca de Chilibre (Expert Diesel, S.A.)

- Alimentos Arel, S.A.

- Expert Diesel, S.A.

- Metal Work, S.A.

- Verdan Switzerland, Corp.

- Premium Rush Shop Middleton Services, S.A.

- Luciano Rodríguez (President)

- Phone: +380-1350 or 6612-0636

- E-mail: [email protected]

- Location: Via Calzada Larga, corregimiento de Chilibre, Panama.

Zona Franca Colon Maritime Investor (Colón Maritime Investor, S.A.)

- Marine Manpower Supply, Corp.

- Servicios Marítimos E Inspecciones, S.A. (Seminsa)

- Talleres Industriales, S.A.

- Tisa Lifeboats & La Services, S.A.

- Ricardo Husband (Manager)

- Phone: +433-9504 or 433-9531

- Location: Calle 15 and 16 and Ave. Central, Province of Colón.

Zona Franca Estatal de Davis (Unidad Administrativa de Bienes Revertidos)

- Leader Packing, S.A.

- Uniplas Industry, S.A.

- Overseas Engineering & Construction Co, Lta, S.A.

- Moto Mundo, S.A.

- Lic. Alberto Chacon (Director of the UABR, Colón)

- Phone: +470-0018- 6670-1297

- E-mail: [email protected]

- Location: José D. Bazán, Davis, Colon Province

Zona Franca del Istmo (Zona Franca del Istmo S.A.)

- Envases Universales Ball De Panamá, S.A.

- Caribbean International Foods, Inc

- Ruth Noriega (Development Manager of Business)

- Phone: +294-7280 ext 7810

- E-mail: [email protected]

- Location: Pan-American Highway, km 25, corregimiento 24 de Diciembre, Panama.

Zona Franca Eurofusión (Eurofusión, S.A.)

- Eurofusión S.A.

- Michael Horth (Legal Representative)

- Phone: +340-6289/90/91/248-6165

- E-mail: [email protected]

- Location: La Valdeza, Capira, Panama.

Zona Franca de Las Américas (Mi Morocho S.A.)

- Cescar, Corp.

- Controles Eléctricos Panamá Free Zone, S.A.

- General Energy & Engineering, Corp.

- Varcom, S. A.

- Mavi América, S. A.

- Abiomed Logistics, Corp.

- Magda Echeverría (In charge)

- Phone: 6582-3009/ +507 396-9398 +507 2633697 / +5072637699

- E-mail: [email protected]

- Location: Parque Industrial Las Américas, corregimiento de Pacora, distrito y Provincia de Panamá.

Zona Franca Marpesca/Corozal (Procesadora Marpesca. S.A)

- (MIS) Maritime International Suppliers Panamá, S.A.

- Administración Marpesca, S. A.

- Adriatic Agencia Naviera, S.A.

- Ap Armor, S.A.

- Bauer Fundaciones Panamá, S.A.

- Biogentax, Corp.

- Bio-Logica Laboratorios, S.A.

- Cross Road Agencies, S.A

- Eastern Marine Supply, S.A.

- Estructuras Rubicon, S.A.

- Furuno Panamá, S.A.

- Industrias Romanina, S.A.

- Marine Pacific Petroleum, Inc.

- Marine Turbo Engineering, S.A.

- Maritima Del Este, S.A.

- Mercantes Del Pacífico, S.A. (Merpacific, S.A.)

- Mirfak Marine Services, Corp.

- Ocean Pollution Control, S.A.

- Ocean Provision, S.A.

- Pana Pool, S.A.

- Panama Hub Logistics, S.A.

- Panama Canal Shipping Supply, S.A.

- Procesadora Marpesca, S.A.

- Proviser, S.A.

- Redemar, S.A.

- Reefer Technician Services, Corp.

- Satlink Services Panamá, S.A.

- Ship Management Panamá, S.A. (Ship Mp, S.A.)

- Stward Agency, Inc.

- Subworks, S.A.

- Supply Chain Solutions

- Terremar Oil & Services, S.A. Antes (Stward Oil Corp.)

- Trans-Corozal, S.A.

- Trans-Pacific Ocean Corp.

- Fotis Lymberópulos (administrator)

- Phone: +317-3600

- E-mail: [email protected]

- Location: Corozal, Ancón, Panamá

Zona Franca Panexport (Inmobiliaria SUCASA. S.A.)

- Alcoholes Y Rones De Panamá, S.A.

- Automation & Power, S.A.

- Consorcio Licorero Nacional, S.A.

- Cosmofarm, S.A., Antes (Switzverdan Corp.)

- Dilupa Panamá, S.A.

- Epoxi-Life De Panamá, S.A.

- I.M. Export American, S.A.

- Kci Export Trading Panamá, S. De R.L.

- Lvic, S.A.

- Imperial Recycling International, S.A.

- Panamá Soluciones Logística Internacional, S.A.

- Prodex Panamá, S.A.

- Pty Bottling, S.A.

- Rones Don Pancho, S.A.

- Sanross Group, S.A.

- Sgs Panama Control Services, Inc.

- Sistemat, S.A.

- Aida Michelle Maduro (Manager)

- Phone: +273-7008 / 206-5433

- E-mail: [email protected]

- Location: Transístmica highway, Ojo de Agua, San Miguelito district, Panama

Panapark Free Zone

- Ajepana, S.A.

- Comercializadora Panacorp, Inc.

- Deluxe Real State International, S.A.

- Dwc Global Inc.

- Free Spirit Filial Panama S. De R.L.

- Globalmat, S.A.

- Hydration Advantage Partners, Inc.

- International Bottling Services, S.A.

- Inversiones 3t, S.A.

- Jojoba Company, Inc.

- Kubic Intralogistics, S.A.

- Mangueras Y Conexiones Globales, S.A.

- Ml Parts, Corp.

- Natulac Foods, Inc.

- Pty Bottling, S.A.

- Multimodal Marine, Inc.

- Panama E-Bay, Pty, Inc.

- Panapark Free Zone Galera N°.17, S.A.

- Prilabsa Logistic, S.A.

- Right-Sourcing Solutions, Inc.

- Uk Latinamerica Corp.

- Vg Logistics, Inc.

- Extreme Cargo, S.A.

- Ultracoat Industries, Inc.

Contact

- Ministry of Commerce and Industries National Investment Directorate Plaza Edison Building, Floor #3 Ricardo J. Alfaro Panama Republic of Panama

- Phone: +560-0686

- Email: Lcda. Amber Ruiz Chaperón

- Free Zone Office: [email protected]

- WebSite: https://zf.mici.gob.pa/home